Tax Credits 2025 Maryland State

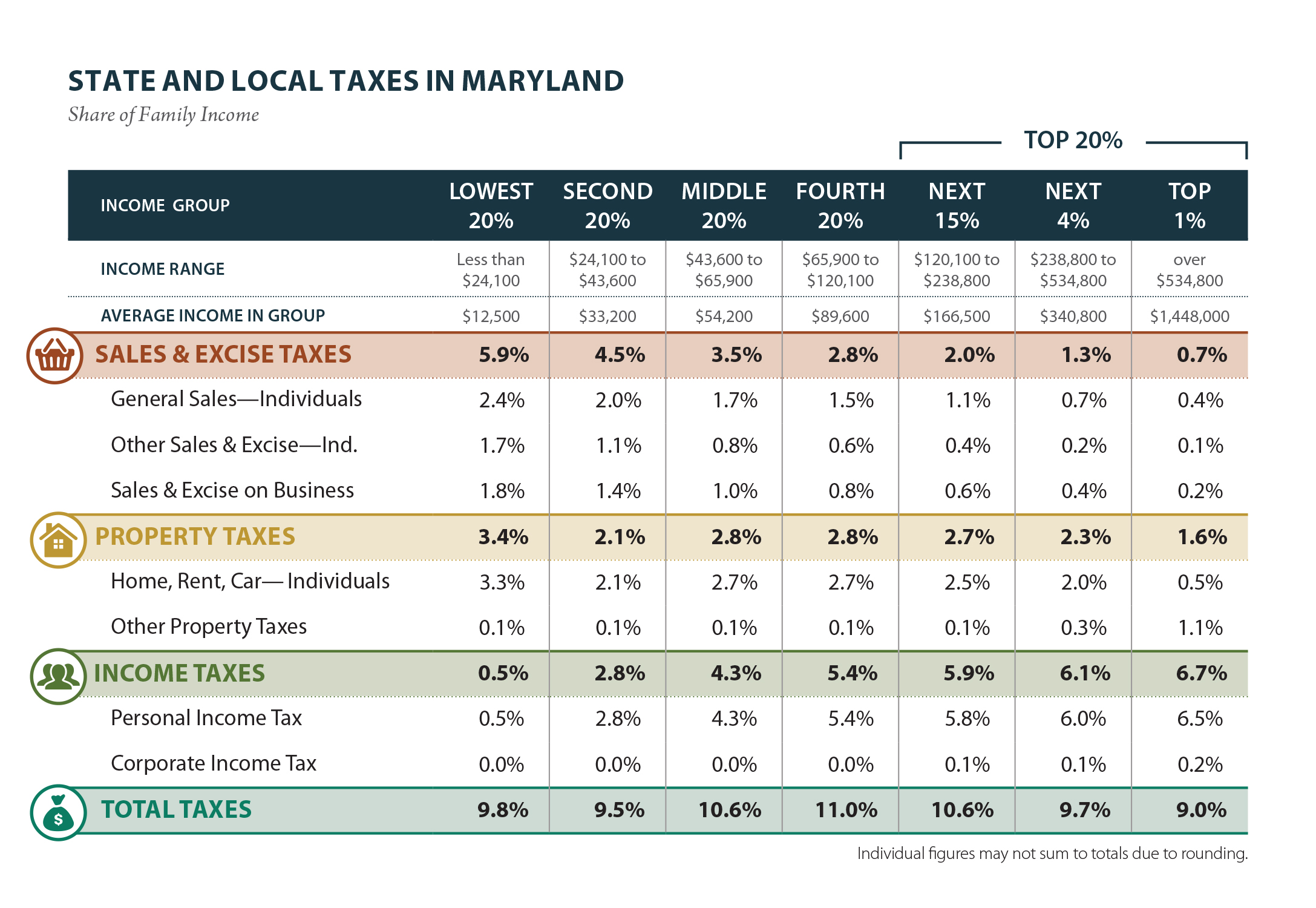

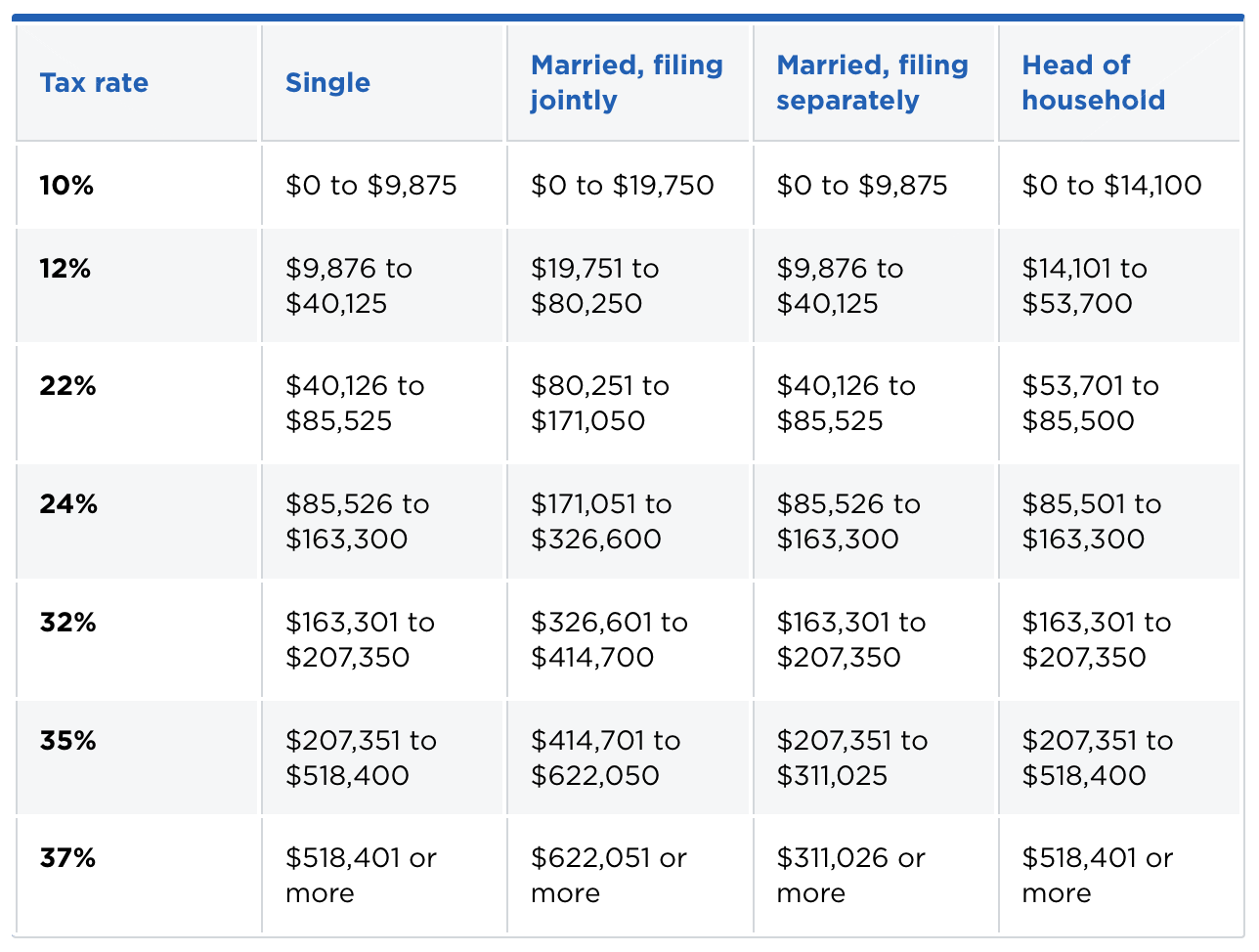

Tax Credits 2025 Maryland State. For tax year 2019, maryland's graduated personal income tax rates start at 2.00% on the first $1,000 of taxable income and increase up to a. This article provides a comprehensive overview of maryland's state income tax system, including the tax rates, brackets, filing requirements, and the key deductions and credits available to.

Tax Credits 2025 Maryland Bryn Marnia, 42 rows to be eligible, you must claim maryland residency for the 2025 tax year, file 2025.

Tax Credits 2025 Maryland 2025 Kara Ronnica, Rebates for charging equipment and installation costs.

Tax Credits 2025 Maryland Trix Alameda, Rebates for charging equipment and installation costs.

Maryland Withholding Tax Facts 2025 Joete Madelin, Maryland offers an electric vehicle tax credit of up to $3,000 for eligible vehicles with a purchase price of less than $50,000.

Maryland form pv 2025 Fill out & sign online DocHub, You can make an estimated payment tax payment on line by direct debit or credit card payments.

Maryland Commuter Tax Credit MDOT, Businesses in maryland may be able to take advantage of several tax credits.

Tax Credits 2025 Maryland For Seniors Joby Melody, This tool is freely available and is designed to help you.

State Of Maryland Estimated Tax Payments 2025 Mira Sybila, Air national guard squadron maryland school report card: